Waste-to-SAF firm Fulcrum Bioenergy files for Chapter 11 bankruptcy

California based waste-to-fuels company Fulcrum Bioenergy has filed for Chapter 11 bankruptcy in District of Delaware US Bankruptcy Court.

The filings showed that Fulcrum Bioenergy and its subsidiaries including Fulcrum Sierra Holdings, LLC, Fulcrum Sierra Finance Company, LLC and Fulcrum Sierra BioFuels, LLC have filed for Chapter 11 bankruptcy.

The companies owe nearly $456m to its creditors. The company is being represented by Robert J. Dehney, bankruptcy and restructuring lawyer at Morris Nichols Arsht & Tunnel.

According to reports, Deheny, while filing for Chapter 11, said that the company was earlier planning on declaring Chapter 7 bankruptcy but changed plans after receiving interest from interested parties. Chapter 7 bankruptcy, often referred to as liquidation bankruptcy, is a legal process designed to help individuals and businesses eliminate their debts. In this process, a court-appointed trustee gathers and sells the debtor’s non-exempt assets.

The filings showed Teachers Insurance and Annuity Association of America (TIAA) as the largest creditor to Fulcrum since it supplied a loan of around $40m to the company.

Moreover, the company owes Marathon Petroleum $858,925 and WM $363,292.95.

What led to Fulcrum’s Chapter 11 filings?

After raising more than $500m from the likes of airbp, United Airlines, Japan Airlines and SK Group over the last 13 years, California-based Fulcrum BioEnergy has apparently closed shop in June earlier this year.

A quick search shows the company’s website has been taken down. Even its LinkedIn page has gone dark. Meanwhile, a report in Bloomberg said that the company laid off nearly 100 of its employees May hinting at a closure of operations.

Fulcrum BioEnergy’s problems were decades into the making. Plans for a launch of flagship facility in Nevada were announced in 2010 which did not materialise. The company set a new deadline for itself: to launch the facility by 2013 but failed to deliver on that as well. It would take the company another nine more years to launch its flagship facility.

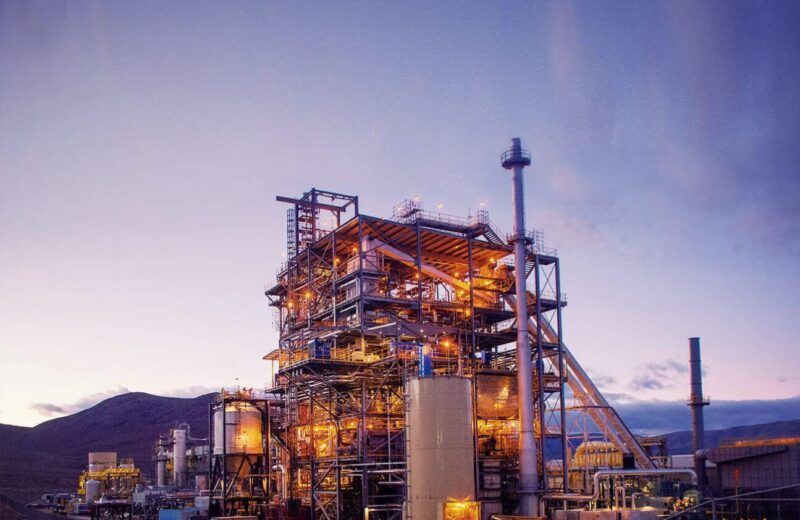

Launched in 2022, the plant was the world’s first site to convert landfill waste into renewable transportation fuels. Fulcrum was betting on converting landfill waste into synthetic gas and processing it into fuel via the Fischer-Tropsch.

The plant cost nearly $200m to build. And things got worse after the launch. First, an internal report from the company said the project was facing technical challenges. Once the Nevada site became operational, the company said it resulted in an unexpected nitric acid build up. It was a massive setback for the company.

In addition to the havoc caused to the machinery by nitric acid, media reports said that the company’s gasification unit was also affected by a thick build-up of sludge. In some cases, the sludge build up was 10 feet high, rendering the plant inoperable. The plant’s failure, which was originally designed to process 175,000 tonnes of landfill waste, raised questions about the viability of the technology itself to process these feedstocks.

But Fulcrum’s nightmare didn’t end here. The company had plans to build two more projects using Reno’s blueprint: one in Texas, Indiana and another in UK. In October of 2023, less than an year after the Reno plant launch, a group of US senators urged the US government to withdraw incentives in place for non-renewable feedstock sources under the Inflation Reduction Act – this included landfill waste. Immediately following this development, Fulcrum announced its decision to delay financing of its Gary, Indiana project dubbed ‘Centrepoint’. The Indiana state authority had already approved nearly $500m bond financing for the project. The company didn’t say that the letter from US senators was behind the Centrepoint decision. However, the timing did support the thesis that the economics of the project didn’t make any sense in the absence of credits under the IRA.

This wasn’t the end of Fulcrum’s financial woes. While the Centrepoint project was being delayed, UMB Bank, which financed the company’s Reno project, said that Fulcrum had defaulted on its $289m outstanding bonds in a notice issued on October of 2023. The bond default raised a lot of questions and investors rushed to cap their losses. SK Inc, investment arm of South Korean firm SK Group, halted invested in Fulcrum. The company had committed $30m in late 2021 to use Fulcrum’s processes to develop a similar project in South Korea.